You are not logged in. Please register or login.

- Topics: Active | Unanswered

Re: Dollar's Demise Can Be Seen Even in the Maldives

Oct. 29 (Bloomberg) -- Bargaining while buying some trinkets in the Maldivian capital, Male, recently, I heard most unexpected words: ``You can keep your dollars.''

This tiny nation of 1,200 islands has long accepted U.S. currency out of convenience for visitors and financial sobriety. The dollar tended to do better in global markets than the local monetary unit, the rufiyaa. That may be changing and it's a bad omen for the world's reserve currency.

``My dollars aren't as popular here as they've been in the past,'' says Moyez Mahfouz, 51, who has visited the Maldives from Bahrain with his family once or twice a year for a decade. ``More and more on this trip, I'm being asked for rufiyaa.''

Why does it matter what happens in the Maldives? Its $1 billion economy is worth 1/59th of Microsoft Corp. co-founder Bill Gates's wealth and 1/27th of Sri Lanka's output. While it's an amazingly beautiful place, the Maldives is a rounding error on the global economic pie chart. Yet it may be a microcosm of a tectonic shift in finance: the demise of the dollar.

These things start out slowly, and in recent months I have had similar experiences from Mexico to Vietnam. In markets, restaurants, taxis and tourist shops that long accepted dollars, many are opting for local currency. The reason: concerns the dollar plunge that analysts have predicted for years is afoot and that the U.S. is uninterested in halting it.

Transformational Event

There's also a nascent realization that something transformational may be happening in global markets. Some states that long pegged their currencies to the dollar are scrapping the policy -- like Kuwait -- while others are quietly considering it. A survey by HSBC Holdings Plc found that twice as many Gulf businesses see benefits from dropping currency pegs to the dollar as those that see negative consequences.

Following Kuwait's May 20 move to drop its dollar peg, Gulf states are under pressure to do the same. The catalyst isn't so much anger over the Bush administration's policies, but how the dollar's slump is raising the price of imported goods. Inflation has reached record levels in Saudi Arabia, the United Arab Emirates, Qatar, Kuwait and Oman in the last 12 months.

President George W. Bush's handiwork doesn't help, of course. In December 2004, former Malaysian Prime Minister Mahathir Mohamad suggested Muslim countries should refuse to trade in dollars and use their economic influence to force a change in U.S. policies. The U.S. ``owes huge sums of money to the rest of the world,'' Mahathir said. ``If people do not keep giving money to the U.S., it will go bankrupt.''

`Rogue Nation'

For years now, Joseph Quinlan, chief market strategist at Bank of America Corp. in New York, has been warning that the U.S.'s image as a ``rogue nation'' is a key force behind the dollar's decline.

The subprime crisis doesn't help, and neither does the perception that U.S. officials -- who recently helped negotiate a bailout fund to calm credit markets -- are protecting reckless investors from losses.

``Bubbles are easier to inflate than to sustain,'' says Richard Duncan, a partner at Blackhorse Asset Management in Singapore, and author of the 2005 book ``The Dollar Crisis: Causes, Consequences, Cures.''

It also hasn't escaped Asians that Treasury Secretary Henry Paulson is talking out of both sides of his mouth. He supports a strong dollar while the U.S. stands to gain from its decline through more-competitive exports and repayment of international debts with cheaper dollars. That's the problem with beggar-thy- neighbor policies -- the neighbors realize what's going on.

Debased Dollar

Investors such as Jim Rogers, too. ``It's the official policy of the central bank and the U.S. to debase the currency,'' Rogers, a former partner of George Soros and chairman of Beeland Interests Inc., said in Amsterdam last week.

Not that the U.S. has enough currency reserves, $44 billion, to halt a dollar crash. The real stockpiles are in Asia. China has $1.4 trillion of reserves, followed by Japan with $923 billion, Taiwan with $263 billion, South Korea with $257 billion and India with $249 billion. Were Asians to dump dollars, the U.S.'s reserve-currency status would be in jeopardy.

The rise of sovereign wealth funds adds another wrinkle. There's much chatter in markets about whether these massive, politically connected funds will shift assets from dollars to euros or other currencies. Islamic finance also gives Gulf states an alternative to dollar-denominated markets.

View From Maldives

There are many arguments against dumping the dollar. The result of diversifying revenue for oil exporters and reserves held by central banks might be a dollar rout, says Larry Hatheway, a London-based analyst at UBS AG. The ensuing jump in U.S. risk premiums and the deflationary impact on the world economy could boomerang on OPEC and central banks via a collapse in oil prices and weaker exports.

With the euro coming into its own, the dollar looking wobbly and some nations miffed by U.S. policies, a slow and steady shift may nonetheless be under way.

Not that the Maldives can tip the balance. Yet the more nations, no matter how small, that begin eschewing the dollar, the bigger the challenges facing the U.S.

Re: Dollar's Demise Can Be Seen Even in the Maldives

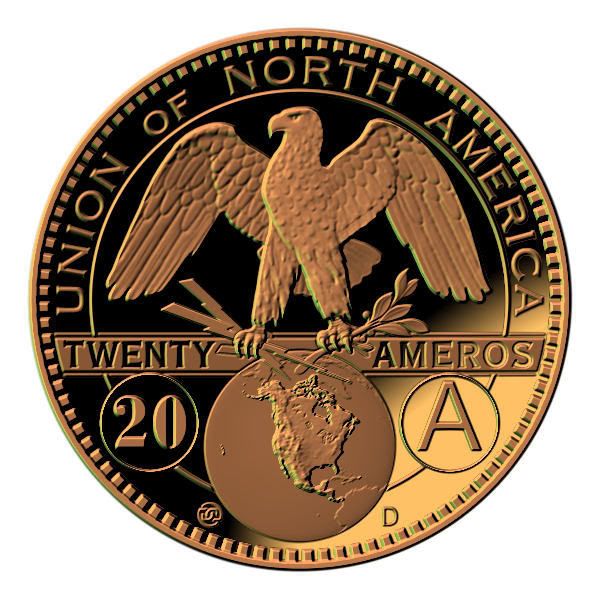

As usual the Government is on top of the situation:

It's getting closer, something the increased reporting from the mass media indicates.

Either way, the unique status of the dollar is over. From now on it will be euros.

Re: Dollar's Demise Can Be Seen Even in the Maldives

I agree that the dollar is dead. Foreign reserves and government bailouts are the only band aids it has. Eventually even that wont prop it up. If they're going to make this switch, they better do it within the next few years, because the US is in big trouble. We are about to enter a deep recession, and a depreciating dollar isn't going to help it.

Am I really the only person that realizes the new currency is going to be almost worthless when it first appears?

All you people out there with a bunch of money saved in dollars better either spend them now, or invest them in something else.

Re: Dollar's Demise Can Be Seen Even in the Maldives

I agree that the dollar is dead. Foreign reserves and government bailouts are the only band aids it has. Eventually even that wont prop it up. If they're going to make this switch, they better do it within the next few years, because the US is in big trouble. We are about to enter a deep recession, and a depreciating dollar isn't going to help it.

That's the plan, don't you think, to use the coming recession and possible terror attack to justify the change of currency and full implementation of the North American Union. To 'save' the economy.

Am I really the only person that realizes the new currency is going to be almost worthless when it first appears?

Not necessarily. The main source of inflation is large interest loans. Given the manpower, political and economic connections, and technology of the country it could go either way, depending on what is the most beneficial to the corporations.

All you people out there with a bunch of money saved in dollars better either spend them now, or invest them in something else.

Gold baby, gold.

Re: Dollar's Demise Can Be Seen Even in the Maldives

Yeah, gold just reached a record high. It beat the old record high set in the mid 80's, which ironically was right after the dollar was at its strongest and has dropped ever since.

I agree that a massive recession and/or terror attack will play a role in creating the new currency/union. It wont save the economy though. It will take years to bring any sort of normalcy to the situation. What's going to back the currency? What will it be pegged against? Will other countries accept it? Creating shit out of thin air isn't going to work with a brand new currency being unveiled by what was once the most powerful country on earth.

This shit is unprecedented.

It pains me to say this and Reagan is probably turning over in his grave at what this country has turned into, but I think we need to switch over to the Euro. Sure, we'll take a massive financial hit, and so will other countries, but we're going to take a financial hit anyways.

The US is basically just a large plane coming in for a crash landing, and the pilot just has to figure out a way of letting us crash with as few casualties as possible.

Re: Dollar's Demise Can Be Seen Even in the Maldives

It's just becoming a global economy. The US dollar & economy is declining, while Eastern European, Russia, China & India are on the rise. Soon China will be exporting cars to US for cheap (Chery i think). Stocks for foreing companies are doing well, as people are investing in them. Hence, salaries & employement for these countries will increase, while US slowly decrease. Not a huge crash, it'll happen gradually. It already is, and the internet has made it an even playing field for all.

As my cousin said; "In a few decades we'll all be working our low paying jobs which were outsourced into the US by Russia & China, leaving work to shop at Walmart. Then going next door to the slot-casino to gamble the rest of our paycheck away"

Re: Dollar's Demise Can Be Seen Even in the Maldives

Its not just a global economy to blame. If globalization was the only cause, we would be prospering right along with it. Our country has lived on credit for too long, and the bill collector is now demanding payment. There's nothing to pay the bill with. We would need a new line of credit to pay it. We actually have to create money out of thin air to pay the interest on our debt.

The 90's boom was a mirage. The dot com crash of the late 90's was a warning sign and everyone ignored it. Its like when Clinton said the budget was balanced(it wasn't), everyone decided to just live it up with money they didn't have. Just because you could get practically unlimited credit didn't mean you should. Now everyone is sunk in debt and driving SUV's with the price of gas on the verge of skyrocketing.

Now all of our companies are overseas, and our manufacturing base no longer exists. It will never return. Now they are even talking about having your fast food orders come from India. When you order your next big mac, it may be someone taking your order in India, and some old man who should have already retired if things weren't so fucked up will be cooking the food for you.

This country is literally running out of jobs, and we have an influx of immigrants coming in daily.

Our country is digging its grave, and we are using shovels from sweatshops in China to do it. The shovels keep breaking so thats why its taking a bit longer than expected.

Re: Dollar's Demise Can Be Seen Even in the Maldives

You know how much it costs to go to the worst ranked University in the UK for 4 years in US terms.... ?

$108,000

Thats just campus charges and tuition fee costs...

- A Private Eye

- Rep: 77

Re: Dollar's Demise Can Be Seen Even in the Maldives

^ Middlesex...

Not that I went there...